Preference shares are common in the financial world. This is an interesting fact that although they.

Shares A Share Is The Interest Of A Shareholder In The Company Measured By A Sum Of Money For The Purpose Of Liability In The First Place And Of Interest

It is usually the first series of stock after the common stock and common stock options issued to company.

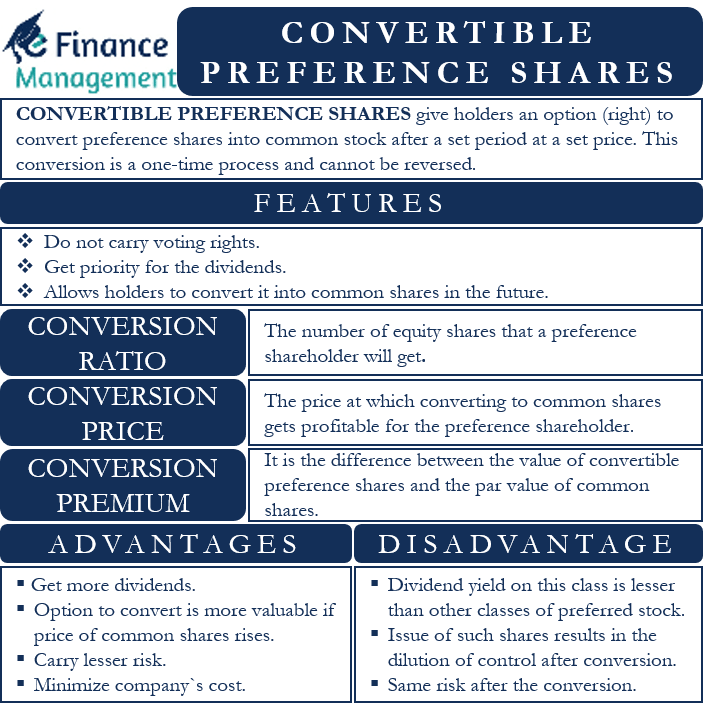

. In trading on Friday shares of AltaGas Ltds Cumulative Redeemable 5-Year Rate Reset Preferred Shares Series A TSX. Equity shares represents ownership in a company. Convertible preference shares are preference shares which are issued with.

Ordinary shares are non-convertible to a different class of shares. In finance a convertible bond or convertible note or convertible debt or a convertible debenture if it has a maturity of greater than 10 years is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. Equity shares are irredeemable but preference shares are redeemable.

A redeemable preference share can be similar to a bank loan. The next major difference is the right to vote. However Preference shares could be converted into equity shares.

Here shareholders are allowed to convert their preference shares into common equity shares. It is a hybrid security with debt- and equity-like features. Redeemable Preference Shares.

The loss included a US173 million non-cash expense from the revaluation of Grabs equity investments that are marked-to-market each quarter as well as US111. To explore more. Preference shares can be convertible or non-convertible.

This is the standard kind of share that has no special restrictions or rights to itEach share offers equal rights to the shareholders of the company. These types of. A company can repurchase or claim redeemable preference share at a fixed price and time.

There are various classes of preference shares including cumulative non-cumulative redeemable participating and convertible preference shares. A series A round also known as series A financing or series A investment is the name typically given to a companys first significant round of venture capital financingThe name refers to the class of preferred stock sold to investors in exchange for their investment. ALA-PRATO were yielding above the 45 mark based on its quarterly dividend.

These types of shares are sans any maturity date. It originated in the mid-19th century and. In case of redeemable preference shares the issuing company can purchase the preference shares back from the holder before maturity.

This is primarily attributed to the elimination of non-cash interest expense of Grabs convertible redeemable preference shares that converted to ordinary shares in December 2021. Companies can only issue redeemable shares when at least one non-redeemable share which has to be a different class of share is in issue. Details of redemption of preference shares indicating the manner of redemption whether out of profits or out of fresh issue and debentures.

This will be the case when eg. Company F has determined that the shares or share options would be classified as equity instruments under the guidance of FASB ASC Topic. Equity shares cannot be converted.

The instruments together bracketed as NCDs include non-convertible debt securities non-convertible redeemable preference shares perpetual non-cumulative preference shares and perpetual debt. Convertible bonds are the most common compound financial instruments and IAS 32 uses them as an example to illustrate its. There are many different types of shares in a private limited company also known as classes of shares and come with different rightsThese include.

Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined. The shares or shares underlying the share options are redeemable for cash at fair value at the holders option but only after six months from the date of share issuance as defined in FASB ASC Topic 718. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable.

When you own equity share you become a part owner and are entitled to the companys profits and losses. The information has been sought from all the entities which do not fall within the definition of company under the Companies Act and which had listed non-convertible securities including non-convertible debt securities non-convertible redeemable preference shares and perpetual non-cumulative preference shares and perpetual debt instruments. Vide Circular Resolution dated 5th September 2022 approved the allotment of Secured Redeemable Non-Convertible Debentures NCDs under 21st TrancheSeries U2022-23 amounting to Rs.

Equity shares cannot be converted into preference shares. Such preference shares are non-redeemable but come with mandatory fixed dividends that are below market rate. The information has been sought from all the entities which do not fall within the definition of company under the Companies Act and which had listed non-convertible securities including non-convertible debt securities non-convertible redeemable preference shares and perpetual non-cumulative preference shares and perpetual debt instruments according to a.

Preference shares are redeemable. Cumulative preference shares With this class of share when a company is not able to pay guaranteed dividends due to insufficient profits in a particular financial year the dividend is accumulated. Types of shares issued for a private limited company.

Requiring the company to pay a fixed interest rate until a certain date and then to repay the capital amount. Redeemable preference shares RPS are a type of preference shares that are issued on terms that they may be redeemed in the future at the companys option or subject to the terms of issue. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position.

This can be done after a certain time period and at a. In general equity shares carry the right to vote although preference shares do not carry voting.

Convertible Preference Shares Meaning Advantages And More

Process For Issue Of Preference Shares Muds Management

What Is The Abbreviation For Redeemable Convertible Preference Shares

Eastern Bank Ltd Eastern Bank Limited Has Raised Bdt 2 600 Million Redeemable Cumulative Non Convertible Preference Shares For United Mymensingh Power Limited A Concern Of United Group To Aid Its Ongoing Operation

Palatin Announces 15 Million Private Placement Of Convertible Redeemable Preferred Stock

Building Greater Value Convertible Redeemable Preference Share Crps Issue Ppt Download

Types Of Shares Prezentaciya Onlajn

Differences Between Equity Shares And Preference Shares Preferences Equity Shared

7 3 Classification Of Preferred Stock

Convertible Preference Shares Prepnuggets

Preference Shares Types 8 Types Scholarszilla Scholarszilla

Building Greater Value Convertible Redeemable Preference Share Crps Issue Ppt Download

Redeemable Preference Shares Examples Definition How It Works

Callable Preferred Stock Preferred Stock Financial Statement Analysis Accounting Principles

Building Greater Value Convertible Redeemable Preference Share Crps Issue Ppt Download

Issue Of Non Convertible Redeemable Preference Shares Taxdose Com

Preference Share Subscription Agreement Dated December 24 2007